UPDATE 12/14: Well, that sure escalated quickly. Robinhood, after receiving pretty heavy criticism over how this checking and savings program might actually work (specifically around whether or not they’d be insured accounts), has now rebranded it as a “cash management” program, pulled the announcement blog post of it, and has sort of put it all in limbo. Ummm, yikes.

You can find their latest blog post on it right here.

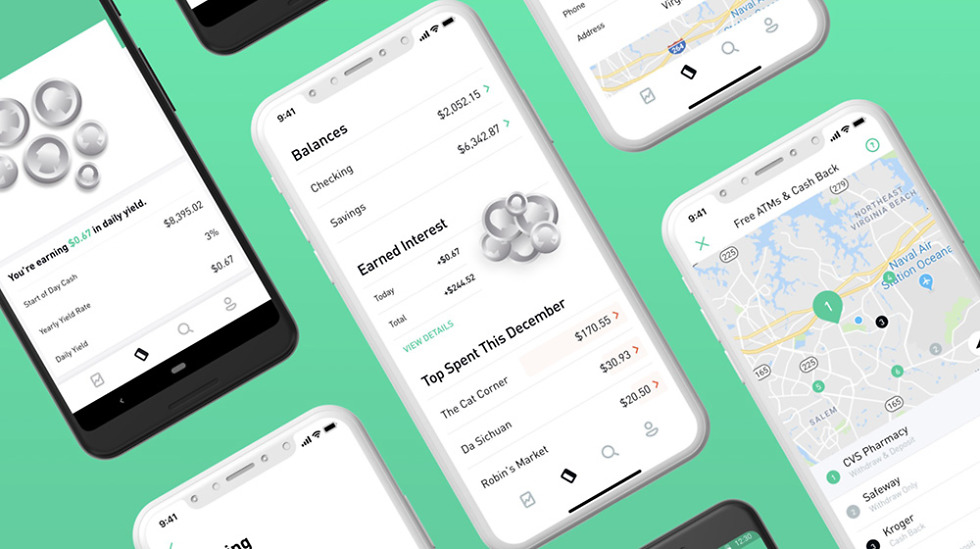

Robinhood, the investment app that has probably changed the trading industry some, thanks to no fee transactions and a super easy-to-use app, announced checking and savings services today. It sure sounds like a pretty big deal too.

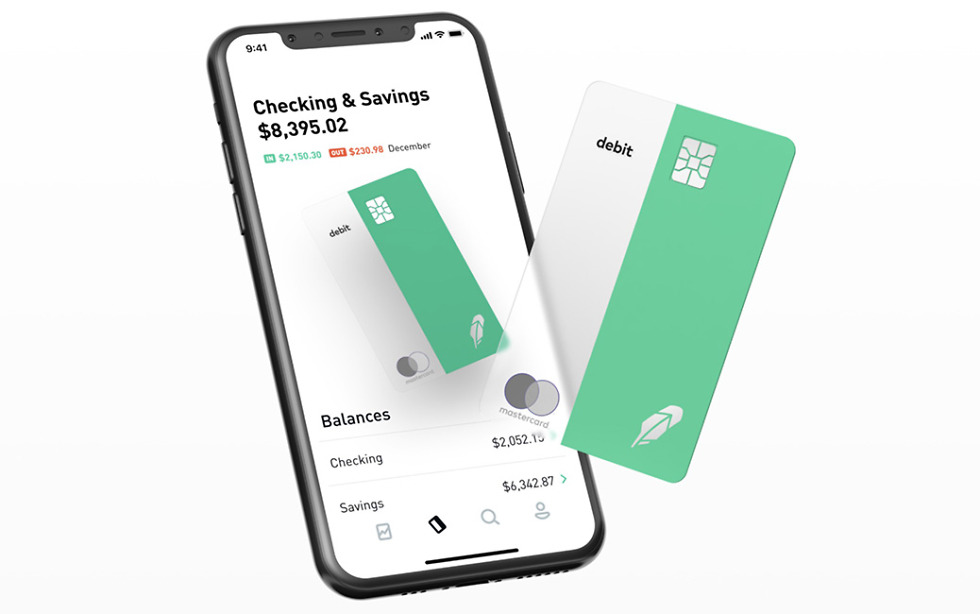

Within the Robinhood app, you now have access to checking and savings (early access for now), both of which earn 3% interest yearly. There are no monthly fees, no overdraft fees, no replacement card fees, and no minimum balance requirements. And yes, they will hand you a MasterCard debit card and give you free cash withdrawals at 75,000 ATMs.

They are taking sign-ups for checking and savings now, with cards starting to arrive in January 2019.

If you have questions about how it all works, a good FAQ is here.

// Robinhood

Collapse Show Comments